kern county property tax calculator

Please contact the local office nearest you. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Automated property tax information is available 24 hours a day by telephone at.

. - A PROPERTY OWNER CANNOT BUY THEIR OWN PROPERTY AT A TAX SALE FOR LESS THAN. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

Kern County Sales Tax Rates for 2022. Find Kern County Property Tax Info From 2021. Not sure what Supplemental Taxes are.

For questions about filing extensions tax relief and more call. This estimator will assist taxpayers who have either recently purchased a property or those considering a purchase during the current fiscal year July 1st - June 30. COUNTY OF KERN TAX RATES AND ASSESSED VALUATIONS 2020-2021 COMPILED BY THE OFFICE OF MARY B.

The Kern County Sales Tax is collected by the merchant on all qualifying sales made within Kern. Please feel free to enter specific property tax for more accurate estimate. TransferExcise Tax Calculator Welcome to the TransferExcise Tax Calculator.

2160 of Assessed Home Value. Purchase Price To the nearest whole dollar. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County.

This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Connect from the office home road or around the world. The median property tax on a 12960000 house is 136080 in the United States.

Kern county property tax calculator. This calculator can only provide you with a rough estimate of your tax liabilities based on the. The kern county sales tax is collected by the merchant on all qualifying sales made within kern.

You can find more tax rates and allowances for Kern County and California in the 2022 California Tax Tables. The median property tax on a 12960000 house is 172368 in Kerr County. Payments can be made on this website or mailed to our payment processing center at PO.

The Kern County California sales tax is 725 the same as the California state sales tax. Method to calculate Kern County sales tax in 2021. 2100 of Assessed Home Value.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Ad Search Kern County Records Online - Results In Minutes.

Businesses impacted by the pandemic please visit our COVID-19 page. The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax payers with an overview of the property tax process in Kern County. Kern County Assessor-Recorder County Terms of Sale - March 2022 Kern County General Tax Sale Information Kern County Tax Sale Brochure List of Title Companies Tax Rate Areas Zoning Departments Zoning Information News and Announcements.

Kern County California Sales Tax Rate 2022 Up to 825. Its also home to the state capital of California. Box 541004 Los Angeles CA 90054-1004.

Property taxes for the second installment of the secured tax bill are now payable and will become delinquent in 46 days. Annual How Your Property Taxes Compare Based on an Assessed Home Value of 250000. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100.

Like taxes though homeowners insurance costs can greatly vary from place to place. KERN COUNTY TAX RATES AND ASSESSED. Whether you are already a resident or just considering moving to Kern County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The countys average effective property tax rate is 081. At that rate the total property tax on a home worth 200000 would be 1620. Welcome to the Kern County online tax sale auction website.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. TransferExcise Tax Calculator Welcome to the TransferExcise Tax Calculator. Kern County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Kern County totaling -025.

Here you will find answers to frequently asked. Understand Kern County California Closing Costs and Fees. Kern County collects on average 08 of a propertys assessed fair market value as property tax.

The median property tax on a 21710000 house is 227955 in the United States. BEDARD CPA AUDITOR-CONTROLLER-COUNTY CLERK. Found inside â Page 95TABLE 19 KERN COUNTY HYPOTHETICAL COUNTY PROPERTY TAX RATES WHICH RESULT FROM SHIFTING THE CITY SHARE OF THE TRACEABLE COST OF LESS.

A county-wide sales tax rate of 025 is applicable to localities in Kern County in addition to the 6 California sales tax. The median property tax on a 12960000 house is 234576 in Texas. Some cities and local governments in Kern County collect additional local sales taxes which can be as high as 2.

We use state and national averages when estimating your property insurance. DeedAuction is part of our offices. The median property tax on a 21710000 house is 160654 in California.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. Click Here for a brief explanation. The Kern County Sales Tax is 025.

Baltimore city has one of the highest median property taxes in the united states and is ranked 543rd of the 3143 counties in order of median property taxes. Online videos and Live Webinars are available in lieu of in-person classes. With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world.

An Important Message for Owners of Secured Property. Sacramento County is located in northern California and has a population of just over 15 million people. This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price.

Learn all about Kern County real estate tax. Here you will find answers to frequently asked questions and the most. The average sales tax rate in California is 8551.

The median property tax on a 21710000 house is 173680 in Kern County. The first installment becomes due and payable on November 1 each year and delinquent on December 10 at 500 pm.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Alameda County Ca Property Tax Search And Records Propertyshark

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Search And Records Propertyshark

Kern County Assessor Recorder S Office Facebook

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Search And Records Propertyshark

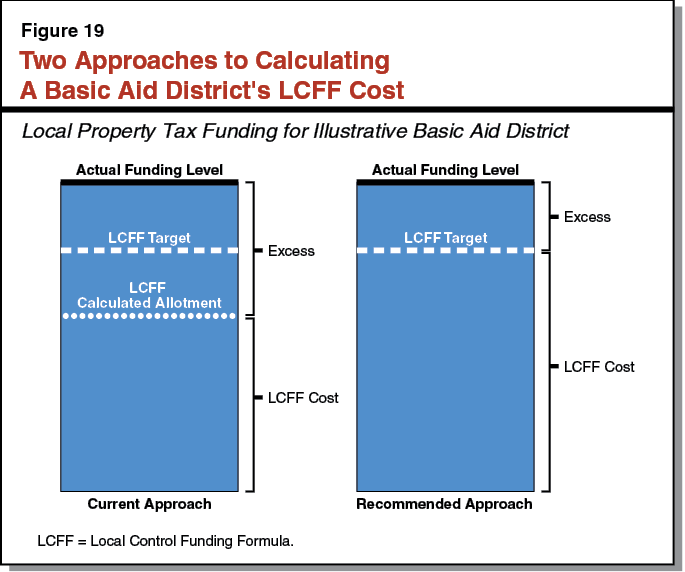

The 2015 16 Budget Proposition 98 Education Analysis

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Search And Records Propertyshark

Kern County Assessor Recorder S Office Facebook

Alameda County Ca Property Tax Search And Records Propertyshark